Hard money lending can be an excellent tool for real estate investors, especially when speed and flexibility are critical. However, like any financial product, it’s important to approach it with a clear understanding of what to do—and what to avoid—to make the most of this opportunity. Here are some essential tips for borrowers navigating the hard money lending process:

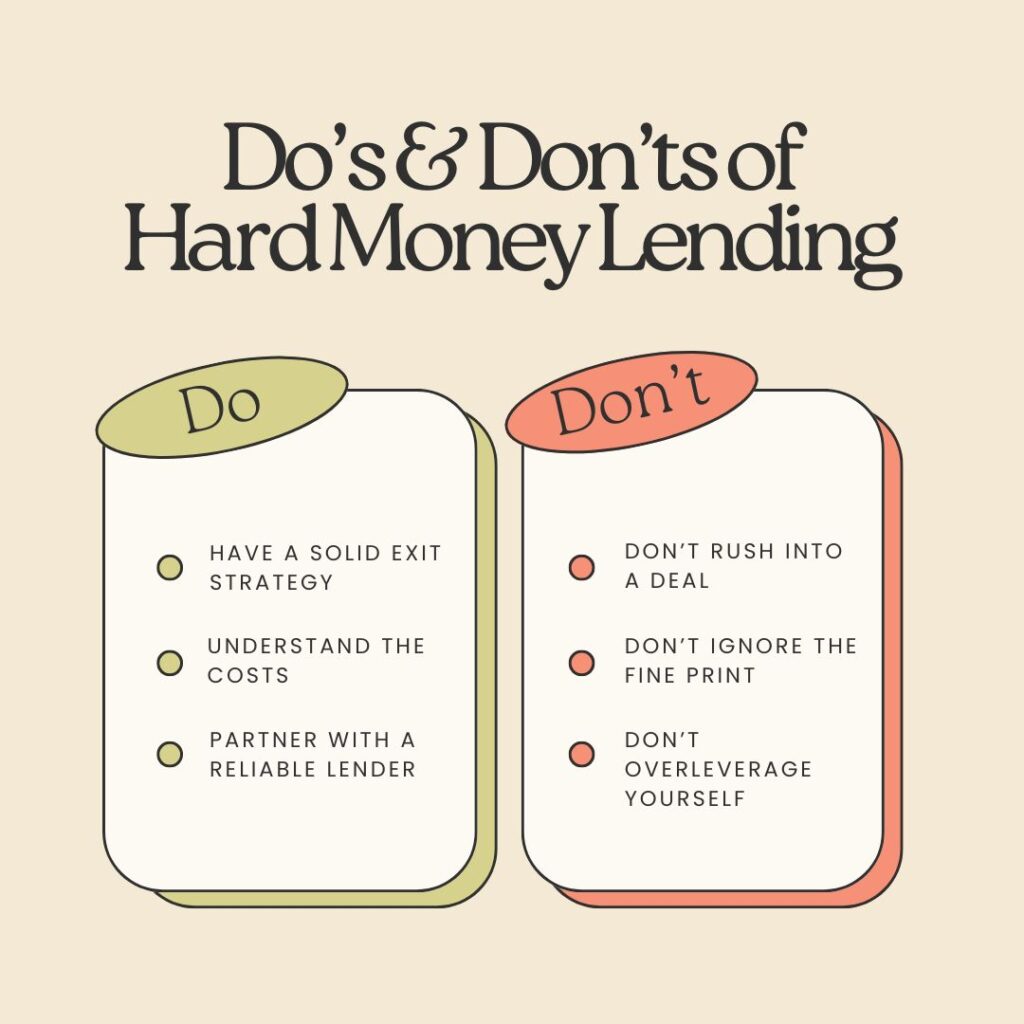

The Do’s of Hard Money Lending

- Have a Solid Exit Strategy

Before taking out a hard money loan, know exactly how you’ll repay it. Most hard money loans are short-term, so a clear exit strategy—whether it’s selling the property, refinancing into a traditional loan, or another approach—is crucial. A well-thought-out plan can keep your project on track and ensure timely repayment. - Understand the Costs

Hard money loans often come with higher interest rates and fees compared to traditional loans. Make sure you fully understand all the costs involved, including origination fees, interest rates, and any potential penalties. Analyze whether the loan aligns with your project’s budget and expected returns. - Partner with a Reliable Lender

Not all hard money lenders are created equal. Choose a lender with a strong reputation, transparent terms, and experience in your local market. A good lender will work with you to tailor the loan to your needs and offer guidance throughout the process. - Do Your Due Diligence

As a borrower, it’s your responsibility to research both the lender and the project you’re undertaking. Ensure the property’s value supports your investment and that the terms of the loan align with your goals. - Prepare All Necessary Documentation

While hard money loans are less documentation-heavy than traditional loans, you’ll still need to provide key information about the property, your exit strategy, and your financial situation. Being organized can speed up the approval process.

The Don’ts of Hard Money Lending

- Don’t Overleverage Yourself

Borrowing more than you can realistically handle is a common mistake. While hard money loans can offer quick access to capital, it’s important to borrow within your means. Overextending yourself can lead to financial stress and jeopardize your investment. - Don’t Ignore the Fine Print

Always read the loan terms carefully. Understand the repayment schedule, interest rates, fees, and any clauses about extensions or defaults. If something is unclear, ask your lender for clarification before signing. - Don’t Rush Into a Deal

While hard money loans are known for their speed, it’s still essential to evaluate the deal thoroughly. Rushing into a loan without assessing the property’s potential or considering alternatives can lead to costly mistakes. - Don’t Assume Hard Money is the Right Fit for Every Project

Hard money loans are best suited for short-term projects like fix-and-flips or bridge loans. They’re not ideal for long-term investments. Make sure the loan aligns with the scope and timeline of your project. - Don’t Underestimate the Value of Relationships

Building a strong relationship with your lender can make a big difference. A trusted partnership can lead to more favorable terms and easier access to capital for future projects.

Hard money lending can be a powerful tool for real estate investors when used correctly. By following these do’s and don’ts, you can mitigate risks and maximize the potential of your investment. If you’re considering a hard money loan, take the time to evaluate your options, understand the terms, and plan your project thoroughly.

At Low Tide Private Lending, we’re here to help borrowers navigate the process with ease. Contact us today to learn how we can support your next real estate investment.