In the dynamic landscape of real estate investing, leveraging the equity in investment properties has become a strategic move for many savvy investors. With home values holding strong, cash-out refinancing has gained popularity. However, navigating the complexities of traditional loans, especially concerning tax write-offs, can pose challenges for mortgage approval. This is where Debt Service Coverage Ratio (DSCR) loans step in to provide a sensible alternative. In this blog post, we’ll delve into the crucial aspects you need to understand when considering a DSCR cash-out refinance.

- What is a DSCR Cash Out Refinance?

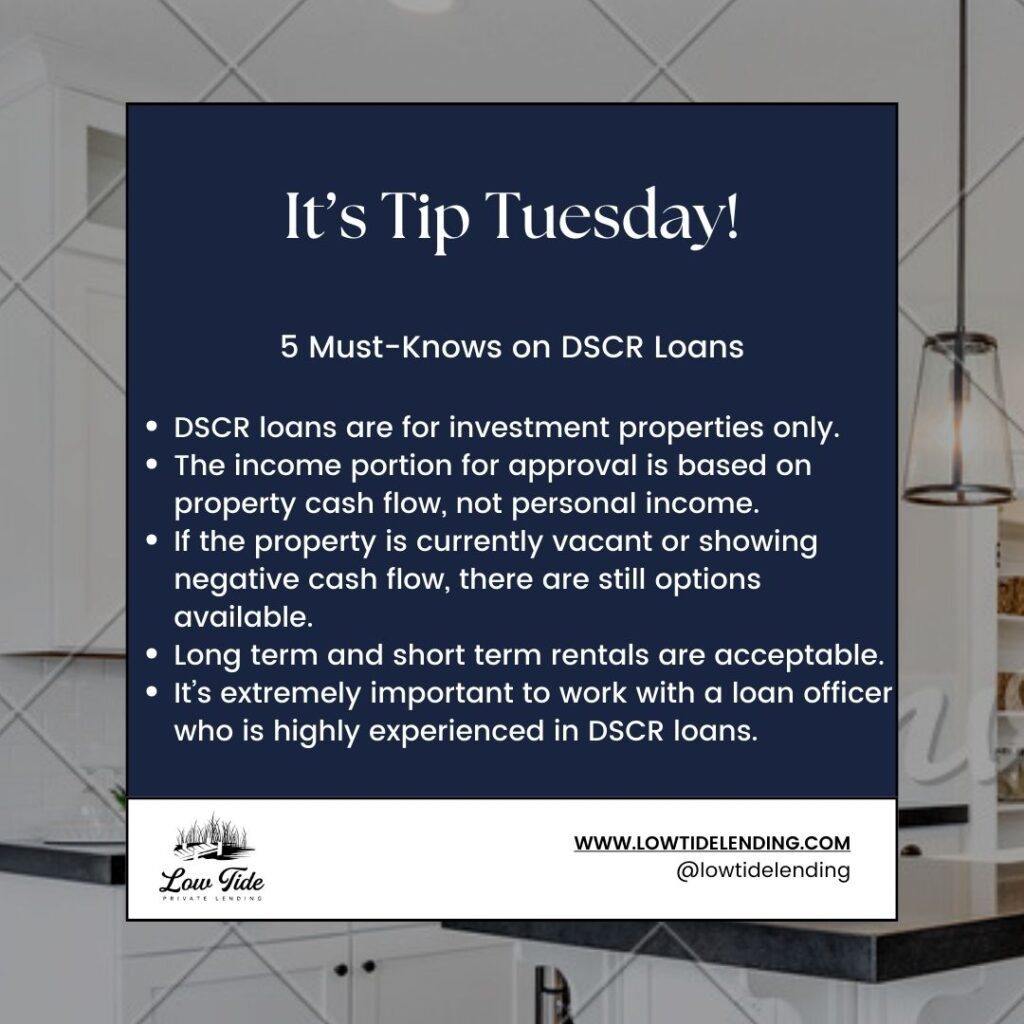

At its core, DSCR stands for Debt Service Coverage Ratio, a formula assessing the cash flow available to meet current debt obligations. In simpler terms, it measures the property’s ability to cover its monthly mortgage payments. The DSCR is calculated by dividing the property’s rental income by its monthly mortgage, taxes, and insurance. Unlike traditional loans, a DSCR cash-out refinance bases the income portion of mortgage approval on the DSCR of the new mortgage payment. - Advantages of DSCR vs. Conventional Refinance:

The primary advantage of opting for a DSCR cash-out refinance is the streamlined approval process. Unlike traditional refinancing, you won’t need to provide tax returns, pay stubs, or W2s. This is especially beneficial for real estate investors with significant tax write-offs that might hinder their eligibility for a conventional loan. A DSCR loan focuses on evaluating your ability to repay based on property income, offering a more commonsense approach. - Uses of Cash Out:

DSCR cash-out refinancing opens up various possibilities for utilizing the funds. Common purposes include home improvement, acquiring new properties, debt consolidation, establishing general reserves, and bolstering working capital. Upon closing, you typically have the option to receive the funds through a check or direct deposit into your bank account. - Determining DSCR on Cash Out Refinance:

To determine the DSCR on a cash-out refinance, you’ll need to provide a copy of the lease agreement. Additionally, a 1007 rent schedule will be ordered along with the appraisal to verify fair market rent. The lower of the lease agreement and 1007 rent schedule is used when calculating the DSCR. Even if the property is vacant, the 1007 rent schedule will be utilized for qualification, with a letter of explanation required. - Handling Negative Cash Flow and Short-Term Rentals:

If your property exhibits negative cash flow or has a DSCR less than 1, there are still options available. Lower loan-to-value ratio requirements may apply, and using the cash-out refinance for property improvements can enhance cash flow. DSCR loans also accommodate short-term rentals, requiring a 12-month rental history or a report from AirDNA Rentalizer for properties with less than a 12-month history. - Is a DSCR Loan a No Doc Loan?

No, a DSCR loan is not a no-doc loan. While it simplifies the income portion of approval by focusing on property income rather than personal income, applicants must still meet credit, asset, and property condition requirements. It offers a more accessible path for investors with unique financial profiles. - Choosing the Right Lender:

Selecting the right lender is crucial for a smooth DSCR cash-out refinance process. Beware of inexperienced loan officers who may set improper expectations. Opt for a broker or loan officer with extensive experience in DSCR loans to ensure a successful and hassle-free closing.

In summary, DSCR cash-out refinancing provides a valuable option for real estate investors seeking to unlock the equity in their investment properties. Understanding the nuances of DSCR, its advantages, and the intricacies of the application process can empower investors to make informed decisions and navigate the path to financial growth.